Madeira Tax Guide 2024

Madeira Tax Guide 2024

1. INTRODUCTION

In the context of the approval of the State Budget Law for 2024, special consideration was given to the proposed amendments to extend the tax incentives regime in force in the so-called Madeira Free Trade Zone. The amendment tabled by the Socialist Party parliamentary group was the proposal that won the vote and was included in the State Budget Law for 2024, published on 29th November 2023 (Law No. 82/2023, of 29th December 2023).

Thus, the deadline for issuing new licences to operate in the Madeira Free Zone was extended until 31st December 2024, and the effects of the regime were also extended for another year, until 2028.

2. GEOGRAPHICAL CONTEXT

Situated off the coast of Portugal, Madeira is a Portuguese archipelago that is part of the European Union (EU) and is officially qualified as an outermost region. The special circumstances of its location and development enable the region to offer a variety of favorable tax regimes, namely free trade zones, lower tax rates and specific tax incentives.

3. INTERNATIONAL BUSINESS CENTER (CINM)

Madeira’s International Business Center (referred to as “CINM”) was created in the 1980’s, aiming to attract international investment as well as boosting economic growth and social development in the region.

CINM consists of a variety of incentives, namely of tax incentives with a view to:

- modernize, diversify, and internationalize Madeira’s goods and services

- allow companies established in the region to compensate and overcome structural inefficiencies and disadvantages derived from the region’s outermost status.

This special regime was originally established as a State Aid regime to develop the region, fully authorized by the EU.

One of the greatest advantages of the CINM regime is the wide list of tax benefits granted to corporations and their shareholders, namely 5% corporate income tax (CIT) rate.

The current benefits provided by the regime apply to entities that are licensed with CINM between January 1st, 2015, and December 31st, 2024. Once granted, the benefits may be applicable until the end of 2028.

MINIMUM REQUIREMENTS

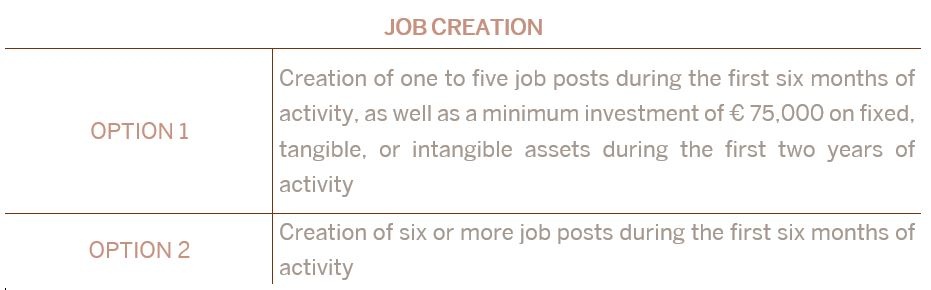

To be entitled to these tax benefits, companies must be duly licensed to operate and meet one of the following requirements:

The renewed regime, in line with the concerns expressed by the European Commission, has introduced new criteria for job creation, namely:

- the number of jobs is determined by the number of people who earn employment income paid or made available by the licensed entity, if they reside, for tax purposes, in Madeira, or if they are not Madeira residents, they carry out their activity therein or are workers or crew members of ships or pleasure boats registered in the International Shipping Registry of Madeira

- permanent employees, part-time employees, or intermittent employees, are considered proportionally to the full-time practice in a comparable situation, measured in number of work units per year.

In this context, the following are excluded from the calculation of the number of jobs created and mantained:

- employees assigned by temporary employment agencies

- employees on a casual assignment regime

- employees under a multi-employer regime, when the employer that represents the others in the employment relationship is not licensed with in Madeira Free Trade Zone.

The new amendment to the Madeira Free Trade Zone regime also specifies that, in order to be eligible to the CINM benefits, any income, expenses or losses must be attributable to an adequate business structure on the licensed entity in Madeira.

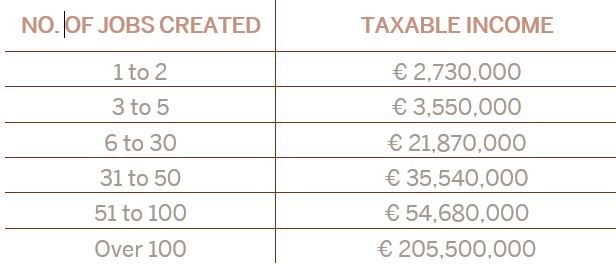

ELIGIBLE TAXABLE INCOME

The tax incentive of the 5% CIT tax rate is only applicable to the following amounts of taxable income, in essence determined by the number of jobs created, as follows:

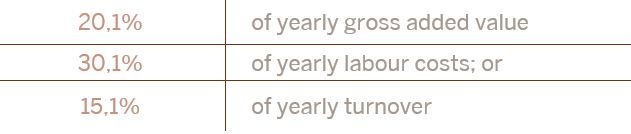

ANNUAL LIMIT

In addition, the tax incentive (i.e. the difference between the standard CIT rate, which currently is 14.7%, and the 5% rate) obtained by the companies under this regime are limited to one of the following annual limits:

INDUSTRIAL FREE TRADE ZONE

In addition to the reduced rate of 5% until 2027, manufacturing companies in the Madeira Free Trade Zone may also benefit from a 50% reduction on their taxable income, provided that at least two of the following conditions are met:

- contribution to the modernization of the region’s economy through the technological innovation of products, manufacturing processes or business models

- diversification of the region’s economy by introducing new high added-value activities

- attraction of highly qualified human resources

- contribution to the improvement of the environment

- creation of 15 jobs for a minimum period of 5 years.

Moreover, these companies will also benefit from an import tax suspension regime, where non-EU incorporated raw materials and components will only be subject to import duties when the final product leaves the Madeira Free Trade Zone.

It should be noted that certain activities are explicitly excluded from this regime - these include enterprises engaged in intra-group activities, in particular head offices and business and management consultancy, as well as those in the financial and insurance sectors. The steel, synthetic fibres, coal and shipbuilding sectors are also excluded, as are agriculture, forestry, fishing, aquaculture and the extractive industries. It is also important to note the exclusion of enterprises in financial difficulties and enterprises subject to recovery orders for unlawful aid. This information is essential for proper tax and strategic management.

Regarding companies licensed in the industrial free trade zone, it should be noted that goods in the free trade zone are considered not to be in the customs territory for the purposes of customs duties, quantitative restrictions and other charges or measures having equivalent effect, without prejudice to the application of provisions that may be adopted in exceptional cases. The same reasoning shall apply for value added tax purposes.

OTHER TAX INCENTIVES WITHIN THE MADEIRA FREE TRADE ZONE REGIME

In addition, companies registered within the CINM are entitled to 80% exemption from stamp duty on documents, contracts, and other operations requiring public registration, provided that other parties involved are not residents in Portuguese territory or are also companies operating within CINM’s legal framework.

Companies under this regime are also granted an exemption of up to 80% of applicable to municipal real estate tax (RET) and real estate transfer tax (RETT), regional and municipal surtax, as well as any other local taxes.

Moreover, CINM also provides a great platform for the successful application of the wide network of international double taxation treaties (DTT) signed by Portugal, as well as the application of EU directives, offering a great competitive advantage over other international markets.

It is also worth noting that an express rule was established to clarify that entities licensed with CINM are subject to a special advance payment of CIT, as well as autonomous taxation, assessed in proportion to the applicable CIT rate, except for:

- autonomous taxation on non-documented expenses;

- autonomous taxation on expenses corresponding to amounts paid or due, for any reason, to non-resident individuals or companies that are subject to a clearly more favorable tax regime, unless the taxpayer can prove that they correspond to real operations that are not of an abnormal or exaggerated amount.

WITHHOLDING TAX EXEMPTION ON DIVIDENDS AND INTEREST PAID TO NON-RESIDENTS

A Personal Income Tax (PIT) or CIT exemption regime also applies to shareholders of companies licensed to operate in the Madeira Free Trade Zone who are not resident in Portuguese territory (with the exception of partners of companies licensed to operate in the Industrial Free Trade Zone or which carry out maritime or air transport activities). This regime also does not apply to well as partners or shareholders resident in countries, territories or regions with privileged tax regimes), in relation to the following income:

- rofits made available to them by such companies, including the amortisation of shares without capital reduction, in proportion to the results that benefit from the application of the reduced rate and, even if they do not, from income obtained outside Portuguese territory, with the exception of transactions carried out with entities domiciled in countries, territories or regions with privileged tax regimes; and

- interest and other forms of remuneration for loans, grants or advances of capital made by them to the company or due to the fact that they do not withdraw the profits or remuneration made available to them.

REGISTRATION

The CINM is available to any duly incorporated legal entity, upon the verification of applicable prerequisites and a proper application is made. The “Sociedade para o Desenvolvimento da Madeira, S.A.” (SDM) is the CINM’s managing entity.

To be noted that the application may be requested by a company that already exists, either in Portugal or abroad, as well as by a soon-to-be-incorporated company. In the latter case, the same requirements and procedures foreseen for existing Portuguese legal entities will apply.

In case of a successful application, the license is granted once the applicant provides proof of the creation and registration of the company.

Licensed entities are subject to an establishment and operating fee:

- Services-oriented companies will be subject to an application fee of € 1,000 and to an annual fee of € 1,800;

- Holding companies (SGPS) will be subject to an application fee of € 1,000 and an annual operating fee of € 1,800 for the first year, and € 1,800 plus 0,5% of the previous year’s profit, with the first 1 million euros being exempt for the subsequent years. This annual fee is restricted to a maximum of € 30,000.

The need to adhere to economic substance requirements was reinforced by the European Commission's announcement in July 2018 that it had begun an in-depth investigation into tax exemptions granted to some companies doing business in CINM.

The aim of the European Commission was to determine whether some of the conditions set out in the decisions issued in 2007 and 2013 (approval of the extension of the CINM regime under EU state aid rules) were being respected.

More specifically, the European Commission questioned the compliance of the following requirements:

- if the profits subject to income tax reductions were exclusively Madeira-sourced;

- the benefitting companies have actually created and maintained jobs in Madeira.

In this context, the Portuguese Tax Administration itself has recently changed its interpretation and legal application procedures to only consider jobs that are in fact created in Madeira as eligible under the CINM regime.

The European Commission's investigation did not negatively affect the existence of the special tax regime, as its purpose was merely verifying compliance with the economic substance requirements.

In fact, it should be noted that the CINM has been included in the scope of the General Block Exemption Regulation (GBER) since 2017. This means that is compatible with the Treaty on the Functioning of the European Union, provided that certain conditions are met. As a result, Portugal does not need to notify the European Commission in advance and obtain its approval for the establishment of the Madeira Free Zone Regime, but only needs to inform the European Commission afterwards.

4. MADEIRA’S INVESTMENT TAX CODE

Additional contractual tax benefits were established in Madeira’s Investment Tax Code with the aim of strengthening regional business and ensuring good market dynamics. This is achieved by introducing incentives to investment and capitalization, particularly in areas such as industry mining, manufacturing, tourism, computer activities and services, research and technology, environment, energy, telecommunications, and IT projects.

Madeira’s Investment Tax Code encompasses four special regimes (however, the tax benefit regarding productive investment is only applicable to investment projects that have been carried out until December 31st, 2027, as detailed below).

PRODUCTIVE INVESTMENT

Investment projects, carried out before December 31st, 2027, are eligible to several benefits, including a tax credit of between 25% and 40% of relevant investments, as well as exemptions and reductions in RET or RETT rates and exemption from stamp duty, for a period of ten years, whose relevant investments amount are equal to, or greater than 750 thousand euros, in Madeira Island, and 250 thousand euros, in the case of developments in Porto Santo.

The framework and maintenance of the regime are subject to several objective and subjective conditions and to certain ongoing obligations.

INVESTMENT SUPPORT

The creation of this incentive, which is not specific to the Madeira Investment Tax Code, but is provided for in national legislation, has resulted from the abolition of the traditional benefits of the remuneration of share capital (“RCCS”) and the deduction of retained and reinvested profits (“DLRR”).

This incentive works by means of a deduction to the taxable income of an amount equal to 4.5% (increased by 0.5% if the taxpayer is considered a micro, small or medium-sized enterprise or a small or medium capitalization company) of the amount of net increases in eligible equity made after January 1st, 2023.

RESERCH AND BUSINESS DEVELOPMENT

Finally, a deduction of 32.5% of the amount invested in research and development is allowed (with the possibility of a rate increase).

FINAL REMARKS

It should be noted that the 5% CIT rate foreseen within the Madeira Free Trade Zone Regime is one of the lowest in Europe. Also of note is the standard CIT rate applicable in Madeira, which is currently 14,7%.

On the other hand, the CINM grants a wide list of tax benefits to non-resident shareholders of registered companies, excluding income related to companies located in lower tax jurisdictions, as well as benefits regarding the distribution of profits.

As for the Madeira Investment Tax Code, it is a useful tool to stimulate the development of business activities. However, its practical application requires a careful analysis and adequate compliance with the applicable requirements.

These instruments also allow Portugal (and particularly Madeira) to function as an attractive investment platform in Europe or other jurisdictions, such as Lusophone Africa.

Furthermore, it should also be noted that the tonnage tax system provides shipping and maritime transport companies established in Madeira with an alternative and potentially more favourable method to determine the taxable income from their shipping activities.

***

Rogério Fernandes Ferreira

Marta Machado de Almeida

Álvaro Silveira de Meneses

Miriam Campos Dionísio

João de Freitas Jacob

José Nuno Vilaça

Joana Fidalgo Barreiro