The 2023 Personal Income Tax Report Filing Season in 2024

The 2023 Personal Income Tax Report Filing Season in 2024

In Portugal, the tax filing season for individuals, corresponding to the obligation to submit an annual Model 3 IRS (PIT) tax return, runs from April 1st to June 30th of the year following the one to which the income relates. In this newsletter we present the essential highlights and the main concerns that taxpayers should consider when submitting their tax return, being the lawyers at RFF Lawyers available to assist the taxpayers in complying with this obligation.

TAX RESIDENCY AND TAXATION IN PORTUGAL

In Portugal, income earned by individuals is subject to Personal Income Tax ("PIT").

Consequently, Portugal will levy IRS on its tax residents – including those who are covered by the Non-Habitual Residents ("NHR") regime – on their worldwide income, which must be reported in the taxpayer's annual income tax return ("Declaração Modelo 3 de IRS").

Taxpayers who are residents (and, once again, including NHRs) are also obliged to declare all their foreign bank accounts, indicating the IBAN and BIC/Swift codes, even if they have not generated any income.

On the other hand, if taxpayers qualify as non-residents, Portugal only subject to taxation income from Portuguese source that has not been yet subject to taxation at the applicable final withholding tax rates, only this income being subject to a reporting obligation.

In either case, the PIT return must be submitted electronically via the Tax Authority's website ("Portal das Finanças") between April 1st and June 30th of the year following the one to which the income to be declared relates. Taxpayers must have a password to access the Tax Authority's website, which they should already know, or which should be requested as soon as possible, but always before the period for filling in and submitting the PIT return.

Bearing this in mind, and considering that, in Portugal, the tax year coincides with the calendar year (i.e. it runs from January 1st to December 31st), if, for example, a non-resident receives property rents from a Portuguese source during the 2023 tax year, they must submit PIT return between April and June 2024, reporting this income.

On the other hand, and still in this regard, it is important to note that, in a given tax year, an individual may be considered partially resident in Portugal. So, for example, if a taxpayer is considered a tax resident in Portugal between January and June of a given year, and as a non-resident between July and December of the same year, that taxpayer will have to declare, in Portugal, their worldwide income earned between January and June of that same year, and only declare their income from Portuguese source that has not been subject to the final withholding tax rates and earned between the months of July and December (which means, in practice, that they may have to file two separate PIT returns, even though they refer to the same tax year).

THE IMPORTANCE OF THE CORRECT QUALIFICATION OF INCOME AND THE NHR

According to the legislation currently in force, income earned by individuals can be taxed under the PIT according to the following categories:

- category A - income from dependent work;

- category B - business and professional income;

- category E - investment income;

- category F - rental income;

- category G – movable and immovable capital gains; and

- category H - pension income.

Each of these categories has a specific method of taxation and may be subject to different tax rates. It should be noted that the State Budget for 2023 introduced the new tax framework applicable to gains derived from crypto assets, including the sale of assets and also the issuance of assets or validation of transactions through consensus mechanisms.

With regard to the NHR special tax regime, it is important to note that this regime grants three main benefits, briefly described as follows:

- firstly, NHR taxpayers who carry out activities considered to be of high added value, in accordance with the Ordinance approved by the Portuguese government, can benefit from a special flat rate of 20%, applicable to income from dependent work (category A) and business or professional income (category B);

- secondly, NHR also benefit from a flat rate of 10% applicable to pension income from a foreign source (category H); and

- thirdly, and with regard to foreign sourced income, the NHR taxpayer may, as opposed to the tax credit method, benefit from the application of the exemption method as the standard method for eliminating the double taxation of their income.

The application of the flat rates of 20% or 10% or the exemption method on foreign sourced income depends, first and foremost, on the correct classification of the income, in the light of the Portuguese legislation in force, as well as the applicable Double Taxation Treaties and depends directly on the correct completion of the PIT return.

In fact, the correct classification and report of income is of the utmost importance if the taxpayer is to obtain all the benefits from the special NHR status.

Incorrectly classifying the type of income earned by the taxpayer can lead to the tax return being filled in incorrectly, which in turn can lead to higher taxation than would have been due if it had been filled in correctly.

On the other hand, if the incorrect completion of the tax return leads to the payment of less tax than would otherwise be due, the Tax Authorities may carry out a future ex-officio correction and possibly even sentence the taxpayer to pay a fine or penalty for (inadequate or) failure to file a tax return.

HIGH VALUE-ADDED ACTIVITIES

In 2019, the Portuguese tax authorities introduced changes to the list of high value-added activities, in order to allow for greater harmonization with the codes of economic activities, as well as the respective recognition of activities carried out by NHR, which, as already mentioned, are subject to special taxation at a flat rate of 20%.

Before this alteration, taxpayers had to notify the tax authorities in advance informing that they were carrying out one of these activities, listed in an Ordinance approved by the Portuguese government, and wait for the tax authorities to exercise their prerogative to recognize (or not) that the type of activity they were carrying out actually met the code indicated. To do this, the taxpayer had to submit a specific application, requesting recognition that their activity should be considered to be of high value-added. It was only after this request had been granted that the 20% rate could be applied, by withholding the income at source and/or by indicating that the activity had high added value (by selecting the relevant code), when filling in the PIT return.

Currently, under the terms of the new procedure designed by the tax authorities, the application of the regime - and the special rate of 20% - does not depend on prior approval, but only on the indication, in the PIT return, of the high value-added activity code in which the taxpayer considers his activity to fall. However, it is essential that the taxpayer collects supporting documentation proving the high value of the activity they carry out and indicates the correct code on their tax return, since the tax authorities may raise questions about the code reported. In other words, contrary to what happened under the previous system, it is no longer necessary for taxpayers registered as NHRs to request recognition of their activity as a high value-added activity beforehand, but only for them to indicate this correctly when submitting their annual PIT return (even though the tax authorities may subsequently raise questions about this activity and request documentation to support the taxpayer's claim).

Therefore, taxpayers who are correctly registered as RNHs and wish to take advantage of this benefit should pay special attention to this issue and ensure that they select the correct options when submitting their tax return, so that the flat rate of 20% on such income is effectively applied.

For this purpose, it is important to correctly indicate the code that corresponds to the activities materially carried out.

TAX DEDUCTIBLE EXPENSES

In order to ensure that the taxpayer ("normal" tax resident or NHR) is able to deduct all allowable expenses, for the purposes of calculating the amount of tax payable, it is necessary for the taxpayer to request, in relation to each purchase of a good or service, the inclusion of their tax number on the invoice issued.

In addition, in order for these invoices to be considered, the taxpayer must also confirm these invoices at a later date, having the duty to check that they have been correctly issued by the service provider or seller of the good.

This procedure presupposes validating the invoices through the Tax Administration's specific page for this purpose (e-Fatura), being necessary to allocate each of these expenses to the corresponding area:

- general and family expenses;

- health expenses;

- education and training expenses;

- housing costs;

- nursing housing;

- car repairs;

- motorcycle repairs;

- catering and accommodation;

- hairdressing;

- veterinary activities; and

- monthly public transportation passes.

It should be noted that this information must be communicated by February 25th of the year following the year in which the expense occurred. In other words, for the expenses incurred in 2023 to be deducted from the taxpayer's PIT, the taxpayer must confirm the invoices on the e-Fatura website by February 25th, 2024, with the submission of the PIT return taking place between April and June 2024.

If the taxpayer notices any omissions or discrepancies in these invoices, they can contest them until March 15th, 2024.

In any case, it should be noted that it is still possible to change the values of invoices communicated via the e-Fatura website directly when filling in the PIT return, which means that, in this case, all invoices will have to be entered manually.

In such situations, the amounts declared by the taxpayer to the tax authorities when filling in the tax return replace any amounts that had been previously communicated, and any amounts exceeding those previously registered must be justified by the taxpayer.

THE COMMON REPORTING STANDARD RULES ("CRS")

Finally, with regard to filling the PIT tax return, it should be noted that there are rules for exchanging information, such as the Common Reporting Standard and the standard for the automatic exchange of financial account information, which consists of international mechanisms for the automatic exchange of tax information between tax administrations in relation to certain facts or income, and this mechanism is already fully in force.

According to these rules, banking institutions report certain types of payments and financial movements related to taxpayers' bank accounts and/or other financial instruments to the tax authorities in their countries, namely:

- interest, dividends and other investment income;

- bank account balances at the beginning and end of each year; and

- life insurance policy balances.

The information exchanged refers to accounts held by individuals resident in any member State that entered in such agreement, under the terms of that State's tax legislation.

This implies, for example, that foreign-source interest received by tax residents in Portugal is reported to the Portuguese tax authorities by their counterpart. It should be noted that this mechanism also makes it imperative to report all bank accounts held abroad.

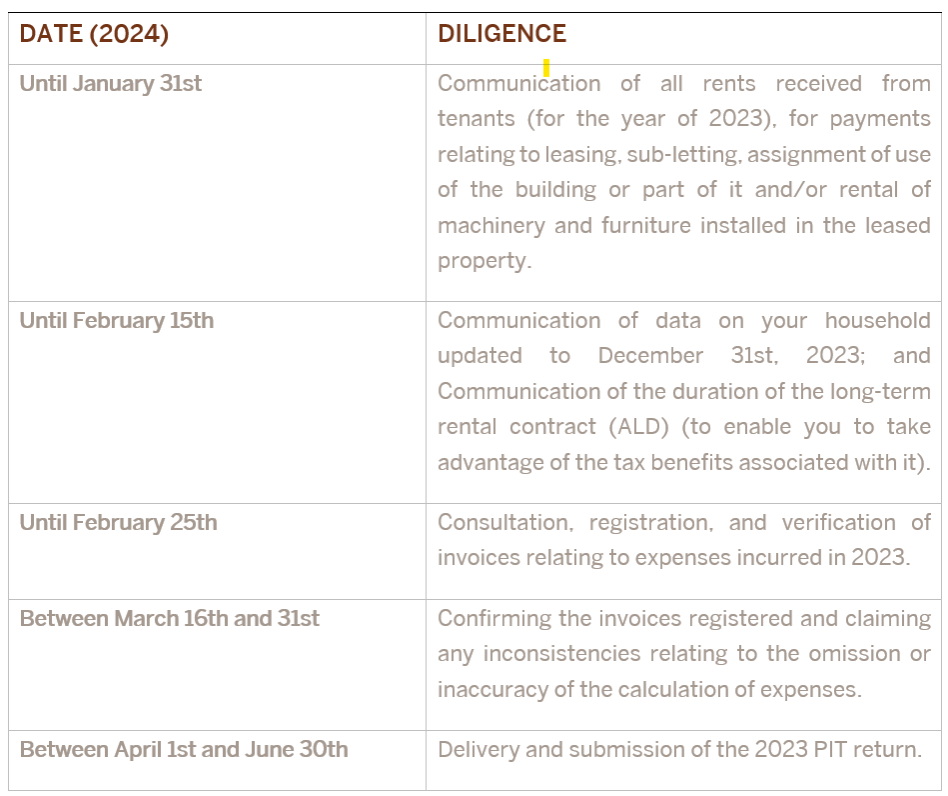

THE 2024 TIMELINE FOR IRS 2023

The Tax Administration has made available the timeline for complying with the due diligence regarding the process of filing and submitting the 2023 PIT return, as shown below:

We note that the consideration of some tax benefits is subject to the timely compliance with the deadlines stipulated above, so we recommend paying close attention to the periods to be taken into consideration.

CONCLUSION

Regardless of the legal and tax status of the individual, whether or not they are resident in Portugal, the classification of their income can be complex, and the use of specialist consultancy and assistance is advisable.

In fact, the correct and accurate classification of income and its correct and timely indication in the PIT return is of the utmost importance in order to guarantee fair and adequate taxation, which translates into the need for a concrete and adequate completion of the PIT return.

***

Rogério Fernandes Ferreira

Duarte Ornelas Monteiro

Joana Marques Alves

Raquel Silva Simões

Ana Sofia Gariso

Amélia Carvela

Carlos Alcântara Neves

João Aguiar Câmara

Nicolas Corrêa Simonini

(Private Clients Team)